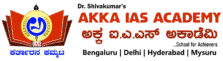

India’s Outward FDI : Growing Dependence on Low-Tax Jurisdictions

Context

A recent analysis of RBI data by The Hindu shows that nearly 56% of India’s outward FDI in 2024-25 was directed towards low-tax jurisdictions such as Singapore, Mauritius, UAE, the Netherlands, U.K., and Switzerland. This reflects a growing pattern where Indian firms increasingly use such destinations to expand globally while gaining tax and regulatory advantages.

What is FDI?

- Foreign Direct Investment (FDI): Investment by an individual or business from one country into a business in another country, with the aim of gaining influence or control.

- Types of FDI:

- Inward FDI: Foreign companies invest directly in India’s economy → brings capital, jobs, technology, and wealth.

- Outward FDI: Indian companies invest abroad → ensures global expansion, risk diversification, and access to new resources/markets.

Trends in India’s Outward FDI

- Use of Tax Havens

- Indian companies increasingly invest through low-tax jurisdictions to channel their FDI.

- A tax haven is a jurisdiction offering low or no taxes, financial secrecy, and stability.

- Volume of Investment (2023-24)

- Total outward FDI: ₹3,488.5 crore

- Share of tax havens: ₹1,946 crore (over 55%)

- Top Destinations (2023-24):

- Singapore – 22.6%

- Mauritius – 10.9%

- UAE – 9.1%

- Together: 40%+ of total outward FDI

- Rising Share in 2024-25

- In the first quarter of 2024-25, low-tax jurisdictions accounted for 63% of outward FDI, indicating a strengthening trend.

Why Indian Companies Prefer Low-Tax Jurisdictions

- Strategic Imperative

- Helps in setting up subsidiaries in Europe, U.S., or third countries via special purpose vehicles.

- Provides better tax positioning during stake dilution and attracts strategic investors.

- Increased Flexibility

- Easier day-to-day transfer of funds and investments.

- Not always for tax evasion—also for operational convenience.

- Platform for Third-Country Investments

- Jurisdictions act as bases for global expansion beyond the immediate region.

- Tax Advantage and Stability

- Offers low taxes and predictable tax policies, unlike frequent domestic tax changes.

- Fund Raising

- International investors prefer investing via Singapore/Mauritius entities due to simpler compliance.

- Protection of Parent Companies

- Intermediate entities shield the Indian parent company from risks.

- Joint Ventures

- Foreign firms often prefer joint ventures through low-tax jurisdictions rather than directly in India.

- RBI July 2025 data: Almost 60% of investments in these jurisdictions were joint ventures.

- Avoiding Tariffs

- High U.S. tariffs on Indian imports encourage firms to set up subsidiaries abroad for value addition, bypassing tariff barriers.

Conclusion

India’s outward FDI pattern shows a strategic reliance on low-tax jurisdictions. While this raises concerns about tax avoidance and profit shifting, for Indian companies it is also a means to ensure global competitiveness, secure investors, raise funds, and manage tariff challenges. Policymakers must strike a balance between leveraging these advantages and preventing excessive dependence on tax havens, ensuring India’s outward investments remain sustainable and transparent.

Source : The Hindu